Mobile PCs show sales gain in U.S. K-12 education market

Mobile PCs, including laptops, notebooks, tablets and handheld devices running a Windows operating system (OS), posted increased year-on-year sales in the U.S. K-12 education market, according to market-research firm Futuresource Consulting.

In a recent report, Futuresource said that sales of mobiles PCs in the U.S. K-12 sector grew 18 percent in 2016, reaching 12.6 million units, up from 10.7 million in 2015. School districts continue to expand their one-to-one learning programs and a robust replacement is developing, Futuresource researchers said. They expect the K-12 shipping growth for mobile PCs in 2017 to remain in double figures, percentage-wise.

“This continued growth in the education sector, when considered against overall declines in PC and tablet sales in all business consumer markets, highlights why PC [original equipment manufacturers] and the major OS providers are focusing so hard on the education market,” researchers commented.

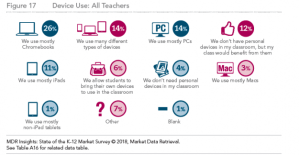

At the OS level, Chromebooks showed gains in K-12 market share, reaching 58 percent last year, an increase from 50 percent in 2015. The combination of affordable devices, productivity tools via G-Suite, easy integration with third-party platforms and tools, task management and distribution through Google Classroom and painless device management remains popular with both U.S. teachers and IT buyers, Futuresource said. The rise of Chromebooks also has established new industry benchmarks on average device cost, with prices declining as low as $120 on certain products.

The report stated that Apple and Microsoft are “not standing still,” despite the significant growth of Chromebooks in the school sector. Both companies made major advances during 2016. Apple, for example, announced its Classroom app and education-focused functionality updates on iOS 9.3, including the ability to share iPads.

Meanwhile, Microsoft launched several products for its learning ecosystem, including Microsoft Classroom and School Data Sync, and announced a suite of Windows 10-based devices targeting the sub-$300 price point, designed to compete directly with Chromebooks, the report said. Microsoft also announced its In Tune for Education, a tool that effectively replicates the Google Management Console and lets IT administrators easily provision and set up large numbers of student devices remotely.

“Microsoft has made huge strides in developing its education ecosystem offering in the past year, with major announcements on both the device and platform side,” said Mike Fisher, associate director of education at Futuresource Consulting. “To date however, these developments have not stopped Google’s momentum within the U.S. K-12 market. Microsoft continues to face challenges to win back end-user mindshare. Chromebook users and administrators continually refer to the simplicity and ease of use of the platform.”

Two-in-one devices are set to become the next must-have technology, including in the education sector, Futuresource researchers predicted. Such devices, which can be used as a tablet or as a notebook with an integrated keyboard for productivity applications, are expected to be a major competitive area in 2017, they said.

“Both Microsoft and Google and their respective partners have announced a wide range of two-in-one products designed specifically for education and are expected to sell for under $300,” the report stated. “The two-in-one form factor is ideal for education, providing schools with flexibility in usage. In addition, the technology behind stylus/pen usage has developed rapidly and ‘inking’ is expected to become widespread and add value to device usage.”

Fisher concluded that “PC providers’ laser focus on the education sector is good news for schools and students; 2017 will see wide ranges of computing devices, designed specifically for education and at competitive price points, entering the market and vying to be the device of choice for learning.”